What's Included in Your UBOT Package

Our comprehensive setup ensures you're fully supported from start to finish, with no hidden fees for the initial process:

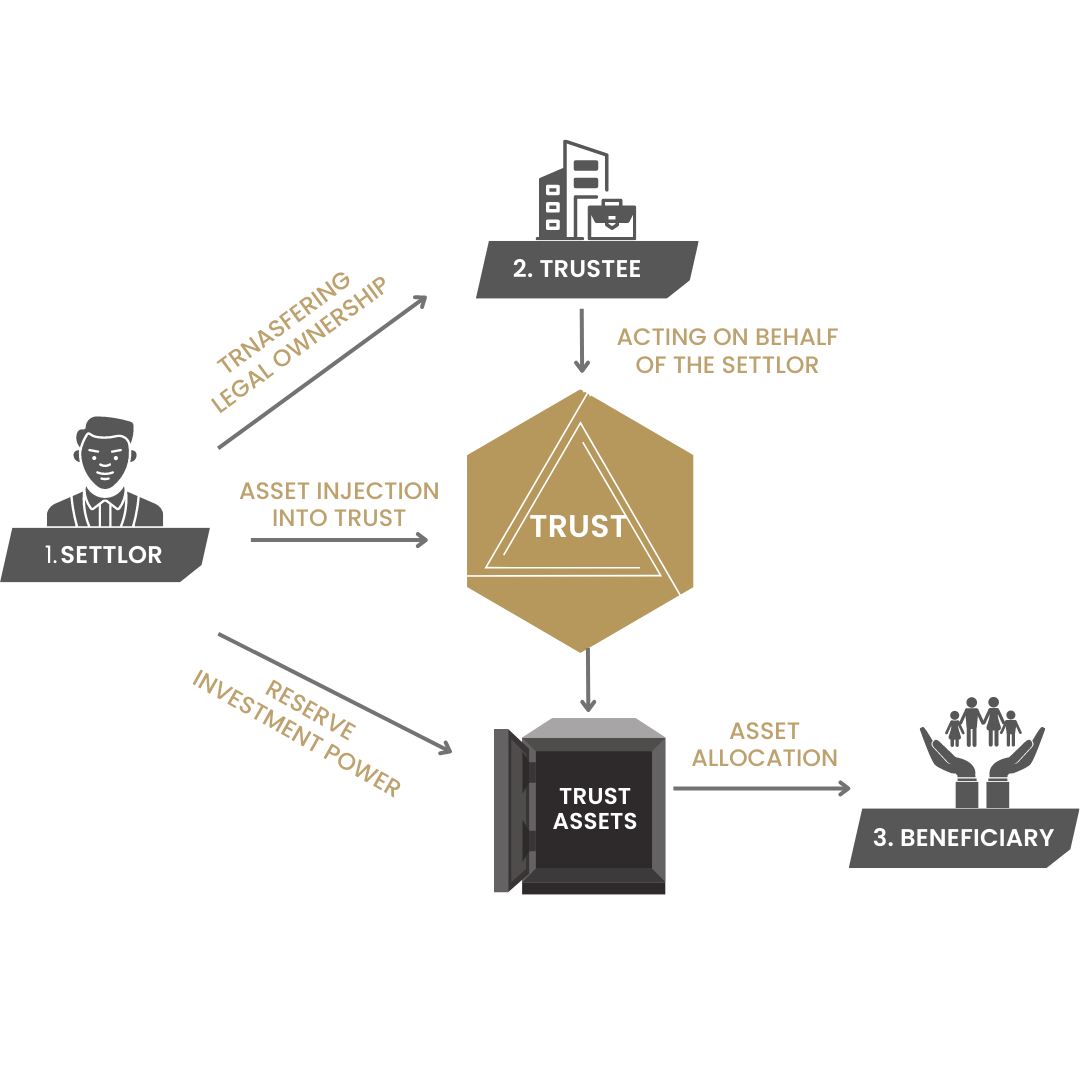

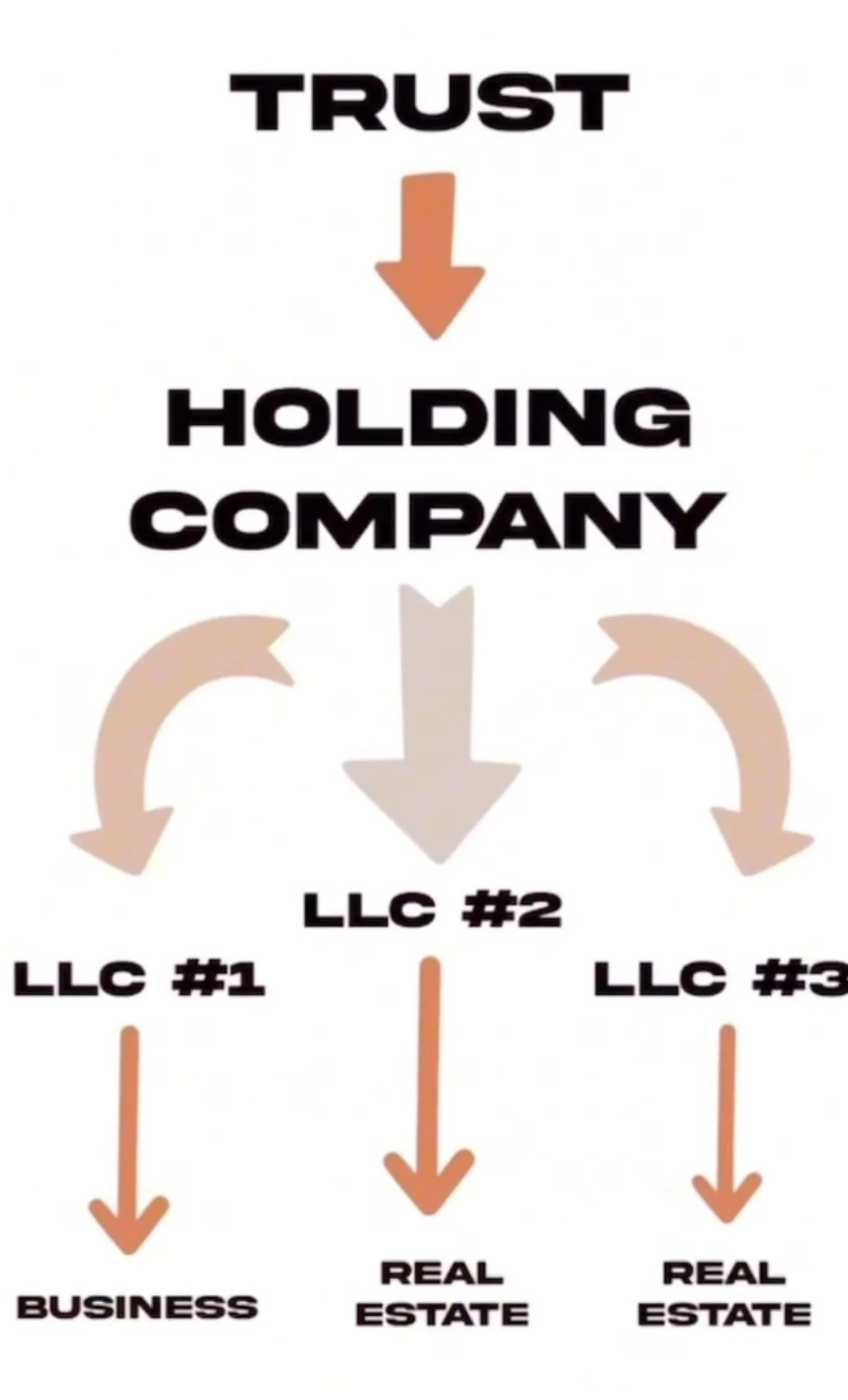

Expert Drafting and Customization: All foundational documents, including the Declaration of Trust and Trust Indenture, drafted by our specialists to fit your unique goals—whether pooling resources for operations, protecting real estate holdings, or separating investments.

Step-by-Step Guidance and Instructions: Personalized help throughout creation, including a detailed guide on administration, beneficiary roles, and transferable trust certificates as proof of ownership.

Document Delivery for Seamless Execution: Receive ready-to-sign files via email (PDF format), a professionally printed and mailed set for your records, and a premium estate binder organizing everything for easy reference.

Practical Setup Assistance: Instructions and support for obtaining your free EIN, opening dedicated bank accounts, and integrating the UBOT into your operations—ensuring privacy, limited liability, and probate avoidance.

Educational Resources: Immediate access to our members-only vault with hundreds of books, articles, and lessons on trust management, tax strategies, and business growth (Free for 1 Month).

This setup leverages constitutional principles (U.S. Constitution, Article 1, Section 10, Clause 1) to defer taxes on income, capital gains, and inheritance until distribution, while offering depreciation benefits and exemption from state or inheritance taxes.

Maximizing Tax Benefits

To unlock the full potential of your UBOT's tax advantages—such as minimizing liabilities and reducing capital gains—we recommend either mastering self-filing through our resources or partnering with a CPA or tax expert familiar with trust structures. This proactive approach aligns with our commitment to financial empowerment, helping you retain more of your hard-earned wealth.

Ongoing Fiduciary Support for Sustained Success

Once your UBOT is established, maintain peak performance with our optional monthly fiduciary services. For an additional fee (starting at $X/month—contact us for details), benefit from expert administration, compliance monitoring, and strategic optimizations. This ensures your trust evolves with your needs, safeguarding your legacy for generations.

Ready to secure your assets and craft an enduring impact? Add to cart now or contact us for a consultation. Explore more on our trust services or deepen your knowledge in our store & Blog.

Disclaimer: Vermilion Vitez provides consulting and trust creation; we are not a law firm or tax advisors. Collaborate with licensed professionals for personalized advice.